Notification No. 35/2025-Customs (ADD), Dated 18-12-2025

1. Regulatory Background

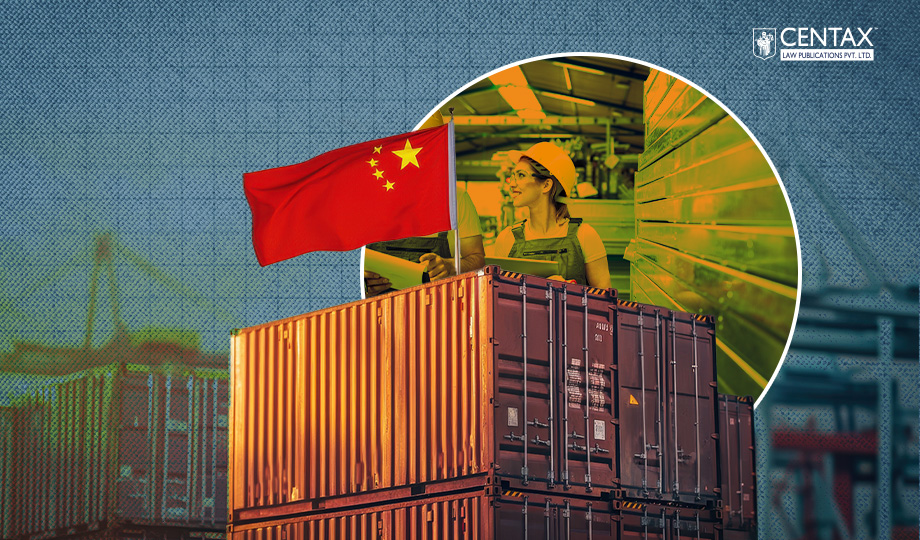

The Central Government has issued a notification imposing anti-dumping duty (ADD) on imports of Cold Rolled Non-Oriented Electrical Steel (CRNO) originating in, or exported from, the People’s Republic of China (China PR).

The measure follows findings of dumping causing injury to the domestic industry and aims to restore fair competition and protect domestic manufacturers.

2. Product Coverage

2.1 Description of Subject Goods

The anti-dumping duty applies to:

- Cold Rolled Non-Oriented Electrical Steel (CRNO)

- Cold-rolled flat silicon-electrical steel products

- Whether or not in coils

2.2 Tariff Classification

Imports are covered under the following Customs Tariff Headings (CTH):

- 7210

- 7225

- 7226

(These classifications are indicative; the levy applies based on product description.)

3. Exclusions

The notification specifically excludes Cold Rolled Full Hard Silicon Electrical Steel, when used as an input for manufacturing CRNO

Such excluded products are not subject to the ADD.

4. Country of Origin/Export and Scope

The duty applies to:

- Goods originating in or exported from China PR

- Imports from any other country, if routed through China PR

This anti-circumvention provision ensures that indirect routing does not defeat the levy.

5. Anti-Dumping Duty Rates

The ADD is imposed at specific rates per metric tonne (MT), as follows:

- USD 223.82 per MT – for specified producers/exporters named in the notification

- USD 414.92 per MT – for all other producers/exporters

The applicable rate depends on the exporter/producer declared in the import documents.

6. Currency and Exchange Rate

- The duty is payable in Indian currency

- Conversion from USD to INR shall be done using:

-

- The exchange rate notified by the Government of India

- Relevant date – Date of presentation of the Bill of Entry

Importers must ensure correct exchange rate application at the time of customs clearance.

7. Period of Levy

- The anti-dumping duty is imposed for a period of five years

- Effective from the date of publication in the Official Gazette

- Unless revoked, superseded, or amended earlier

The levy will therefore apply throughout the notified period to all eligible imports.

8. Practical Implications for Importers

Importers of CRNO should:

- Factor the ADD into landed cost calculations

- Ensure accurate declaration of:

-

- Product description

- Tariff classification

- Country of origin/export

- Producer/exporter details

- Review supply chains to avoid routing risks via China PR

- Update contracts and pricing to account for the five-year duty horizon

Incorrect declaration or non-payment may result in:

- Short-levy demands

- Interest and penalties

- Extended scrutiny by Customs

9. Regulatory Intent

The imposition of ADD seeks to:

- Counter dumped imports at unfair prices

- Safeguard the domestic electrical steel industry

- Maintain market stability and fair trade practices

- Prevent circumvention through third-country routing

10. Key Takeaway

Imports of Cold Rolled Non-Oriented Electrical Steel (CRNO) from China PR are now subject to anti-dumping duty ranging from USD 223.82 to USD 414.92 per MT, applicable for five years, payable in INR at notified exchange rates. Importers must ensure strict compliance from the date of Gazette publication.

![[Opinion] Customs Broker Liability Under CBLR 2018 – Legal Position and Trends](https://www.centaxonline.com/blog/wp-content/uploads/2025/12/2.-Opinion-Customs-Broker-Liability-Under-CBLR-2018-–-Legal-Position-and-Trends.jpg)