Notification No.32/2025 – Customs (N.T.), Dated 28-04-2025

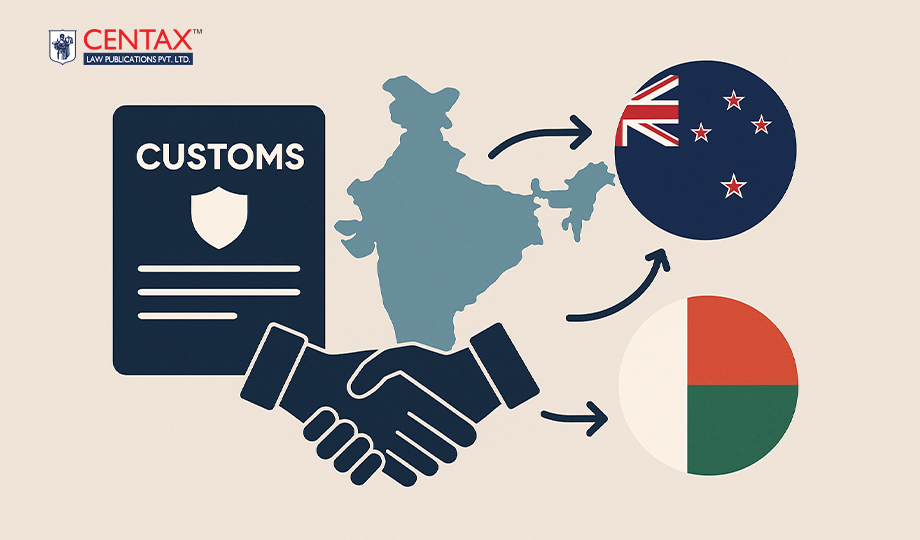

The Ministry of Finance (Department of Revenue) has issued a notification amending Notification No. 58/2021–Customs (N.T.), dated 01st July 2021, to further enhance international collaboration in customs enforcement and administration.

1. Inclusion of New Countries

Through this amendment, the Republic of Madagascar and New Zealand have been added to the table listing countries with which India has entered into Agreements or Arrangements on Cooperation and Mutual Administrative Assistance (CMAA) in customs matters.

These agreements facilitate:

- Exchange of information to prevent and investigate customs offences,

- Mutual assistance in enforcement of customs laws and regulations, and

- Enhanced cooperation for smoother cross-border trade and compliance.

2. Objective of the Amendment

The primary aim of such CMAA arrangements is to:

- Strengthen international customs cooperation,

- Improve enforcement capabilities and detection of smuggling or customs fraud, and

- Facilitate legitimate trade through enhanced transparency and procedural coordination.

3. Implications for Stakeholders

The inclusion of New Zealand and Madagascar under the CMAA framework is expected to:

- Aid faster resolution of customs-related queries and disputes involving these jurisdictions,

- Support risk-based assessments and intelligence-sharing for better monitoring of cross-border transactions, and

- Contribute to trade facilitation and regulatory compliance for importers, exporters, and customs authorities alike.

This amendment reflects India’s continued commitment to aligning with international standards in customs enforcement and trade facilitation through bilateral and multilateral cooperation mechanisms.