Case Details: Meghmani Organics Ltd. Versus Union of India (2025) 30 Centax 130 (Guj.)

Judiciary and Counsel Details

- Bhargav D. Karia & D.N. Ray, JJ,

- Shri Paresh M. Dave, for the Petitioner.

- Shri Dhaval D. Vyas, for the Respondent.

Facts of the Case

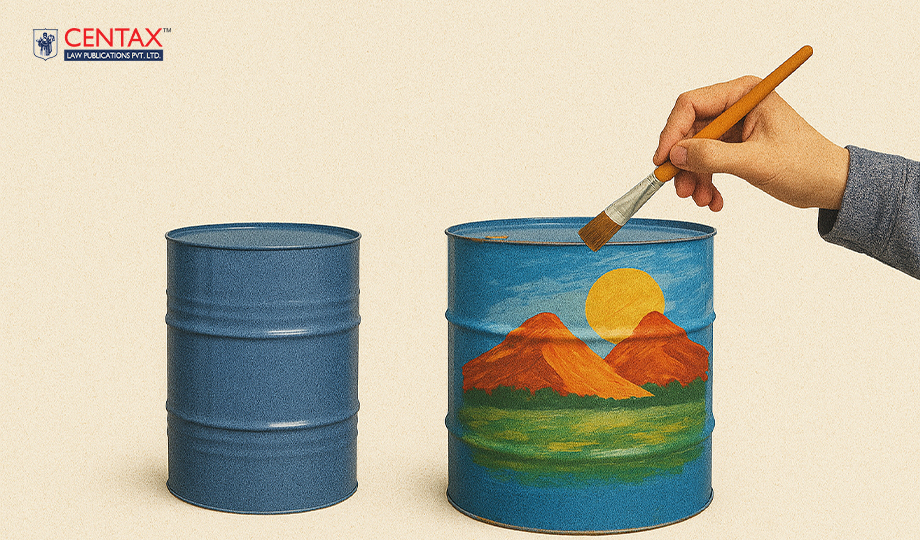

The petitioner, a manufacturing entity, operated two units—one at Ankleshwar and another at Chharodi—during the period from August 2011 to June 2013. The goods were initially manufactured and cleared from the Ankleshwar factory under Central Excise invoices, with the applicable Central Excise duty duly discharged at that stage. These goods were packed in Mild Steel (M.S.) drums at the Ankleshwar unit, each drum affixed with a paper slip containing all relevant information. Subsequently, these packed drums were transferred to the petitioner’s Chharodi unit. Upon receipt at the Chharodi unit, the goods underwent further processing consisting of labelling and painting with specific details mandated by the statutory requirements of the country to which the goods were to be exported.

The department raised a demand for additional excise duty on the ground that this labelling and painting constituted manufacture and hence was liable to excise duty. The petitioner challenged this demand before the CESTAT, which upheld the revenue’s stand that labelling and painting amounted to manufacture. Aggrieved by the CESTAT order, the petitioner filed a writ petition before the Gujarat High Court contesting the excise demand on labelling and painting.

High Court Held

The Hon’ble Gujarat High Court held that labelling and painting on M.S. drums amounted to ‘manufacture’ under Note 3 to Chapter 18 of the Central Excise Tariff Act, 1985, attracting excise duty. The Court upheld the CESTAT’s decision that this process constituted manufacture at the Chharodi unit. Consequently, the excise demand was sustained, and the petitioner’s challenge was dismissed.

List of Cases Cited

- Commissioner v. Jindal Drugs Ltd. — 2024 (389) E.L.T. 4 (S.C.) = (2024) 18 Centax 104 (S.C.) — Relied on [Paras 4, 7]

- Jindal Drugs Ltd. v. Commissioner — 2015 (325) E.L.T. A106 (Tribunal) — Relied on [Paras 4, 6, 8]

- Meghmani Organics Ltd. v. Union of India — R/Special Civil Application No. 5960 of 2018, decided on 2-8-2018 by Gujarat High Court — Referred [Para 6]