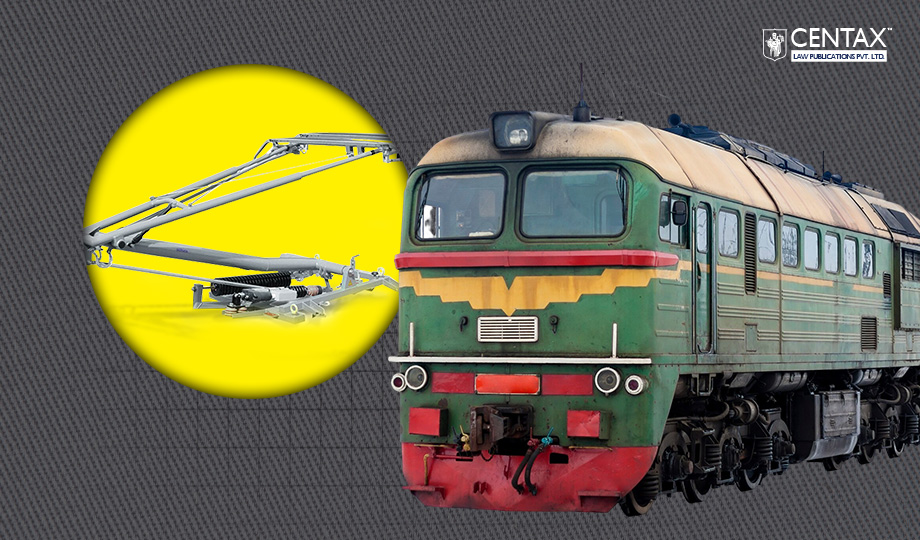

Case Details: Faiveley Transport RailTechnologies India Pvt. Ltd. Versus Commissioner of GST & Central Excise, Salem (2025) 30 Centax 432 (Tri.-Mad)

Judiciary and Counsel Details

- S/Shri P. Dinesha, Member (J) & M. Ajit Kumar, Member (T)

- Shri Raghavan Ramabhadran, Adv., for the Appellant.

- Shri P. Ayyamperumal, Special Counsel, for the Respondent.

Facts of the Case

The appellant-assessee, engaged in supplying pantographs and their parts exclusively for use in railways and tramway locomotives, contested the classification of these goods. The assessee classified the pantographs under Chapter Heading 8607 of the Central Excise Tariff Act, 1985, whereas the Department of Revenue contended for classification under Chapter Heading 8535.

The impugned adjudication order was cryptic and non-speaking, merely stating that classification under Central Excise is governed by the Notes to Sections/Chapters of the Schedule to Central Excise Tariff Act, 1985. The adjudicating authority classified the goods under Chapter Heading 8535 without addressing the substantive issue or discharging the burden of proof on the Revenue. The matter was accordingly placed before the Madras Customs, Excise and Service Tax Appellate Tribunal (CESTAT).

CESTAT Held

The Hon’ble CESTAT held that the impugned order was unsustainable as it was cryptic and non-speaking, failing to discharge the onus on the Department of Revenue to prove that the pantographs fell under Chapter Heading 8535. The Tribunal observed that classification under Central Excise must follow the legal provisions and explanatory Notes of the Tariff Act, and usage or application cannot override these statutory classifications. Since the Revenue failed to establish its claim through a reasoned order on merits, the classification declared by the appellant under Chapter Heading 8607 was upheld.

List of Cases Cited

- Commissioner v. Hitech Computers — 2015 (321) E.L.T.A274 (S.C.) — Referred [Para 10]

- Commissioner v. SKF India Ltd — 2009 (239) E.L.T. 385 (S.C.) — Relied on [Para 20]

- GD Goenka Pvt. Ltd. v. Commissioner — (2023) 11 Centax 2 (Tri. – Del.) — Relied on [Para 19]

- H.P.L. Chemicals Ltd. v. Commissioner — 2006 (197) E.L.T. 324 (S.C.) — Relied on [Para 12]

- Hi-Tech Computers v. Commissioner — 2005 (180) E.L.T. 356 (Tribunal) — Referred [Para 10]

- Parle Agro (P) Ltd. v. Commissioner — 2017 (352) E.L.T. 113 (S.C.) — Relied on [Para 12]

- Polyplex Corpn.Ltd. v. Union of India — 2014 (306) E.L.T. 377 (All.) — Relied on [Para 9]

- Pushpam Pharmaceuticals Company v. Collector — 1995 (78) E.L.T. 401 (S.C.) — Relied on [Para 18]

- Shri Swamiji of Shri Admar Mutt v. Commissioner, Hindu Religious and Charitable Endowments Dept. — AIR 1980 SC 1 — Relied on [Para 12]

- Union of India v. Garware Nylons Ltd. — 1996 (87) E.L.T. 12 (S.C.) — Relied on [Para 12]

- Westinghouse Saxby Farmer Ltd. v. Commissioner — 2021 (376) E.L.T. 14 (S.C.) — Referred [Para 3.1]

List of Notifications Cited

- Notification No. 4/2014-C.E., dated 17-2-2014 [Para 3.1]

- Notification No. 12/2016-C.E. [Para 3.1]